As students embark on their academic journeys, the financial aspect can often be a challenging hurdle. From tuition fees to textbooks, the costs can quickly accumulate. In this article, we explore the option of quick bank loans for students, providing a guide on how to navigate educational expenses with ease.

The Need for Quick Loans

Educational expenses can arise unexpectedly, leaving students in need of immediate financial support. A quick online loan offers a solution to solve the problem between financial needs and available resources. Whether it’s covering tuition fees, purchasing study materials, or handling unforeseen emergencies, these loans provide students with timely assistance.

Advantages of Quick Bank Loans

- Speedy Processing

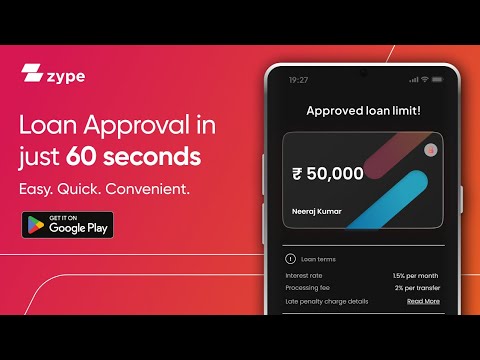

One of the primary benefits of quick bank loans is the swift processing time provided by a reliable personal loan app. Students can access funds promptly, allowing them to address urgent financial requirements without delays.

- Flexible Repayment Options

Many banks offer flexible repayment plans tailored to accommodate the financial circumstances of students. This flexibility ensures that repayment is manageable, considering the often limited income of students.

- Low-Interest Rates

Compared to alternative financial options, such as credit cards or private lenders, bank loans for students often come with lower interest rates. This feature helps students minimize the overall cost of borrowing.

Application Process Simplified

- Documentation Requirements

The application prepared for the fast bank loan or credit line is planned to be student-friendly. Whereas documentation is fundamental, it ordinarily includes essential confirmation of enrollment, recognizable proof, and in a few cases, a co-signer.

- Online Application Platforms

Many banks now offer online application platforms, streamlining the process for students. This digital approach enables quick submission of required documents and accelerates the loan approval timeline.

Considerations Before Applying

- Evaluate Your Needs

Before applying for a quick bank loan, carefully evaluate your financial needs. Create a budget outlining the specific expenses you intend to cover with the loan to ensure you borrow an amount that aligns with your requirements.

- Research Interest Rates

Different banks may offer varying interest rates. Research and compare the rates offered by different institutions to secure favorable terms.

- Understand Repayment Terms

Educate yourself on the repayment terms and conditions about your instant loan. Be aware of the grace period, monthly installment amounts, and any potential penalties for late payments. Clear understanding ensures a smooth repayment process.

Responsibility in Borrowing

- Borrow Only What You Need

It’s crucial to borrow only the amount necessary to cover educational expenses. Avoid the temptation to borrow excess funds, as it can lead to unnecessary financial strain during the repayment phase.

- Financial Literacy

Develop financial literacy to understand the implications of borrowing. Be aware of how interest accrues, the impact on credit scores, and the importance of timely repayments for future financial endeavors.

Conclusion

In the world of student finances, quick bank loans emerge as a valuable tool for navigating educational expenses efficiently. By understanding the advantages and approaching borrowing responsibly, students can leverage these loans to ensure a smoother academic journey. Remember, financial decisions during your non-professional years can set the stage for a more secure and successful financial future.