Life is full of surprises, but sometimes, a few surprises do not make us happy. Instead, people can face emergency needs for cash to solve those unpredictable circumstances. Instant personal loans can be a savior in that case. Instant personal loans bring a wide range of benefits that really make them the best thing to fall back on.

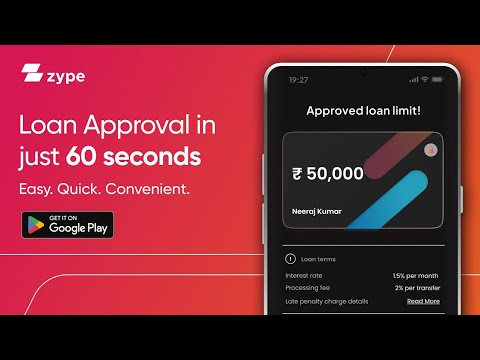

Besides, the demand for instant personal loans has increased significantly. To satisfy this demand, lots of online mobile lending apps make it easier to borrow instant funds while in need. But when you want to avail of an online instant loan, you need to learn the nitty-gritty of the whole process. It will help you to find the best loan online instantly. Here are some do’s and don’ts to follow before applying for online instant personal loans.

Do’s of online instant personal loan:

- Always compare different platforms: As the demand for online loan assist is increasing, a lot of online places are offering personal loans. You should always compare several platforms so that you can find the cheapest interest on the loan amount. Besides, some may have other kinds of benefits like flexible repayments, customized EMI facilities, etc.

- Total amount to be paid: As the loan amount is already huge, you have to calculate the total amount after adding interest. You can use the in-built loan EMI calculator of the lender’s app. Or else, you will find EMI calculators online. Finding the total amount will help you to be aware of the amount to be paid in the future.

- Check your budget ability: Always go for a flexible instant loan suitable to your ability. It is a wise option to fit your financial ability and loan repayment ability at the same level.

- Review the lending app: Always check whether the money lending app is reliable or not. Go through the reviews of previous borrowers. It will save you from any kind of fraudulent lending companies. So, keep this thing in mind whenever you will go for an instant personal loan.

- Check terms and conditions: Make sure to review online terms and conditions before applying for a personal loan. Additionally, exploring the use of a loan calculator can provide valuable insights into potential repayment scenarios and help you make informed decisions about the terms offered by lenders.

Don’ts of online instant personal loan:

- Too many loans at a time: Do not apply to more than one loan at a time. Especially, if you are borrowing for the first time, apply to only one loan. It will save you from a financial crisis. You also do not need to take the burden of several loan repayments.

- Do not miss EMIs: Never miss the due date of loan repayments or EMI payments, and consider utilizing a loan calculation tool to plan and manage your payments effectively. It has a few side effects. Firstly, you need to pay late fees as a penalty. Secondly, it can lower your credit score. If the credit score is lower, automatically, creditworthiness will be lower, too. In the future, you may face issues while applying for online personal loans.

Documents you should arrange before the loan application

As a borrower, you have to submit a few things online for loan verification.

- Government-approved ID card

- Salary slip

- Age proof

Conclusion:

Personal loans are real game-changers for many. With benefits like easy repayment or emergency funds, you should consider this as your financial assistance. You also do not need to keep something as a security of the loan. That means there is no such burden. The only thing you need to keep in mind is repaying the loan on time. Missing the due date may affect the credit score. So, if you are planning to enjoy the benefits of online loans, choose the suitable one.