Consider you are in a situation where some emergency comes, and you don’t want to spend all your savings in one go. You can apply for an instant loan easily and get the required funds immediately. A personal loan is very easy to get when compared to other loans. And there is no paperwork required when it comes to personal loans. All you need to have is a steady income and a good CIBIL score.

Eligibility Criteria

A personal loan has very simple eligibility criteria. If you are a salaried person or self-employed, you can avail of personal loans by submitting the required documents in the instant loan app. Banks or NBFCs will offer personal loans to those who are 23 to 60 years old. And they should have a minimum salary of 25000. Based on the salary and CIBIL score, the lender will perform the loan calculation and release the fund.

No collateral

Personal loan lenders don’t ask for any collateral or security from the borrower. That’s why the personal interest rate is a little higher than any other loan.

Flexible tenure

You can choose the tenure and EMI amount based on your eligibility criteria in the quick loan app. But before taking a loan, you have to calculate your expenses and then decide on how much you can spend for EMI. You can also make use of the EMI loan calculator to check the approximate loan EMI. Based on the calculated amount, you can avail of a personal loan.

To get a personal loan in minutes, try the below tips and tricks.

Apply Online

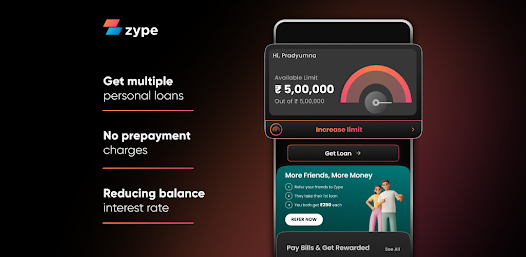

For quick loan approval, you can apply online. The offline process involves a lot of paperwork, and it will be delayed for approval. In the online app, you can raise a request for a personal loan, upload all the required documents, and get it verified in minutes. So, always choose the online process instead of going to the bank physically and waiting in a queue.

Co-applicant in personal loan

If you need an additional loan or if you have a low CIBIL score, you can go with the option of co-applicant. You can include someone with a good CIBIL score and income and add them as a co-applicant in your loan for fast loan approval.

Financial obligation

Your loan amount will be processed according to your monthly salary and credit history. Financial obligation and income ratio should fall under 40%. If so, your loan will get approved immediately. Be it from a personal loans app or bank, the chances of getting loan approval are higher. And if you have additional income, you can include that as well.

Credit score

Your credit score is important for taking a personal loan. Maintaining a score above 700 will help you get immediate disbursal of loan to your account. Please don’t go for multiple applications as it will affect your CIBIL score. Take a desired amount and choose a short repayment tenure to maintain a healthy credit score.

Conclusion

You have all the required information about the loan, loan approval, and all the processes that you should follow to get a quick disbursal of the loan. Follow all the tips mentioned above. Among all the things, you should know your stability of income and repayment of EMI on time.