Each industry functions by implementing a quid pro quo model. Hence, for each service or product you purchase, there exists a consideration for the service, commonly known as price. Therefore, a trading account is no exception. If anyone uses their trading account to purchase and sell securities, they need to pay brokerage to the stockbroker. This is charged for the trading services and platforms offered by your broker.

However, if you are wondering how to trade using your zero brokerage account, you need to open a trading and zero brokerage demat account.

Zero Brokerage Trading Account: Meaning

A zero brokerage trading account is an account with no brokerage charged on any of your trades. A traditional trading account requires the account holder to pay a certain fee for the total value of the trade as a brokerage. On the other hand, while using a zero brokerage trading account to invest in stocks, you need not pay any brokerage fee. However, the kind of brokerage account you open determines whether you need to pay any brokerage fee or only the fees levied on equity delivery transactions.

Key Considerations When Selecting A Zero Brokerage Trading Account

Choosing the perfect zero brokerage demat account for investment is a crucial decision and should be made after detailed consideration and research. Some major factors to consider while selecting a zero brokerage trading account include the following:

- Security and safety: Security must be a top priority when making financial decisions. Therefore, when choosing a zero brokerage trading account, make sure that the brokerage firm implements strong security features to safeguard your crucial financial and personal data.

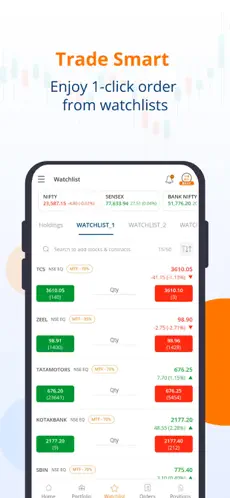

- Tools and features: When selecting a zero brokerage trading account, make sure to check all the tools it offers. Look for major factors, such as setting alerts for price movements, access to real-time market analytics, data and news updates, and updated charting options. Search features can eventually boost your trading experience and offer you the information required to grab profitable opportunities.

- Customer support: Trading is a diverse field, and you might encounter challenges or doubts while trading or investing. This is why you need reliable customer support to help you throughout your investment process. Hence, look for any option trading app India that provides reliable and responsive customer support.

Why Open A Zero Brokerage Trading Account?

By opening zero brokerage trading accounts for investment, investors can explore the following benefits:

- Reduced money outflow via brokerage charges

- More incentive to trade

- Access to market analytics and reports

- Convenient and safe platform for trading

- Zero pressure from relationship managers to delve into a specific number of trades

- Analyze and handle your investment portfolio from a single account

Conclusion

Opening a trading account is a perfect way to get the most from your stock market investments, along with saving on brokerage fees. You can experience a hassle-free trading experience using a zero-brokerage trading account. In addition, with the reduced brokerage fees, you get to focus more on grabbing short-term opportunities, learning new strategies, and boosting your returns.