Investing in the stock market requires the right tools, and one of the most essential is a Demat account. For new and seasoned investors alike, opening a Free Demat Account can be the first step toward building long-term financial stability. By choosing the right account type and understanding how to create a Demat account effectively, investors can make their journey smoother, cost-efficient, and future-ready.

Understanding the Importance of a Demat Account

A Demat account is the digital space where shares and securities are stored electronically. Instead of holding physical certificates, investors manage their holdings in a secure and transparent manner. For long-term investors, this structure is crucial as it ensures safety, easy tracking, and quick transactions.

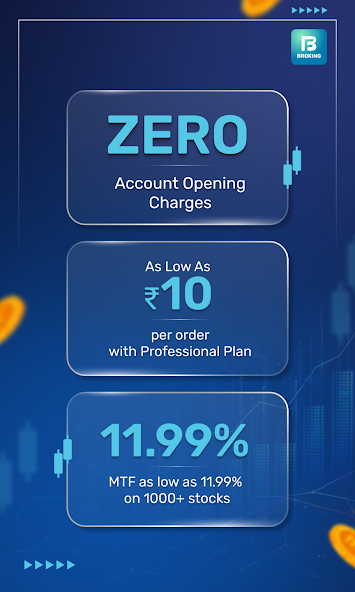

Free Demat Account options provide accessibility without initial setup costs, making them attractive to beginners as well as experienced individuals who prefer cost-saving methods in managing investments. Knowing how to create a Demat account effectively can make this process simple and practical.

Why Choose a Free Demat Account

A Free Demat Account eliminates certain charges that would otherwise be paid during account creation. This makes investing more approachable for individuals who want to test the waters or gradually build a portfolio. Long-term investors find this particularly useful as they can save on upfront fees and allocate more resources toward actual investments.

The ability to create Demat accounts at no cost also encourages wider participation in the market. More investors are able to diversify their holdings, plan for long-term wealth, and reduce unnecessary expenses.

Key Features of Free Demat Account Options

Free Demat Account options come with several notable features that appeal to investors who prioritize growth and security over the years:

- Safe electronic storage of shares and securities.

- Reduced paperwork and streamlined record-keeping.

- Easy transfer of securities whenever required.

- Lower entry barriers for beginners due to zero account creation costs.

- Long-term suitability for investors who wish to hold assets for decades.

These features allow investors to concentrate on wealth-building strategies rather than administrative challenges.

Steps to Create Demat Account

For investors interested in getting started, the steps to create Demat account are clear and systematic:

- Select a registered participant that offers Free Demat Account options.

- Complete the application form with accurate personal and financial details.

- Provide documents for identity and address verification.

- Review the terms associated with the Free Demat Account.

- Once approved, the account is activated, and securities can be stored digitally.

Following these steps ensures that long-term investors begin with a secure foundation, making portfolio growth more manageable.

Free Demat Account for Long-Term Investors

Long-term investors often focus on consistency, safety, and gradual wealth creation. With a Free Demat Account, they can:

- Keep their investments protected for decades without worrying about paper certificates.

- Build diversified portfolios across multiple asset classes.

- Track holdings seamlessly with digital records.

- Reduce costs that would otherwise accumulate during account creation.

The ability to create Demat accounts without initial charges allows long-term investors to focus more on strategy and less on costs.

Comparing Free Demat Account and Paid Options

While paid Demat accounts may offer additional features, many long-term investors find that a Free Demat Account suits their needs effectively. The absence of setup costs makes it easier for investors to enter the market and stay invested over time.

When planning to create a Demat account, investors should consider their personal goals, trading frequency, and preferred investment strategies before making a choice.

Practical Tips for Using a Free Demat Account

- Regularly review holdings to align them with long-term goals.

- Keep account information secure to prevent unauthorized access.

- Use the account primarily for investment purposes rather than frequent trading.

- Monitor charges related to maintenance or transactions, even in Free Demat Account options.

By adopting disciplined practices, long-term investors can maximize the benefits of their accounts.

Common Misconceptions About Free Demat Account

Some investors believe that Free Demat Account options may come with hidden complexities or limited features. In reality, most accounts provide the same essential services as paid ones, with the main difference being cost. The process to create Demat account remains consistent, offering transparency and reliability.

Addressing these misconceptions helps more individuals embrace digital investing confidently.

Long-Term Value of Free Demat Account Options

The real strength of a Free Demat Account lies in its long-term benefits. Investors can securely build wealth, reduce unnecessary costs, and adapt to changing market conditions with ease. With the proper mindset and strategy, the decision to create a Demat account at no cost supports sustainable growth.

Conclusion

A Free Demat Account is more than just a cost-saving option; it is an entry point to disciplined, long-term investing. For individuals aiming to build lasting wealth, understanding how to create a Demat account effectively is a crucial step. These accounts combine affordability with functionality, making them ideal for long-term investors who value security, growth, and financial independence.

By starting with a Free Demat Account, investors set the foundation for consistent wealth-building and ensure that their journey in the financial markets remains both accessible and future-oriented.