Why the Best Personal Loan Isn’t Always the Lowest Rate

When searching for the best personal loan, most people focus on one factor alone: the interest rate. While this approach seems logical, it often leads borrowers to overlook other important elements that affect the true cost and usability of a loan. In reality, the lowest rate does not always translate into the most suitable or affordable loan option.

With the rise of digital lending platforms and every quick loan app promising instant approvals, borrowers are flooded with choices. Each loan offer may look attractive at first glance, but the fine details often tell a different story. Understanding how a loan works beyond its rate helps you avoid financial stress and make a smarter borrowing decision.

This article explains why the best personal loan is defined by more than just numbers and how evaluating the full structure of a loan leads to better outcomes.

Understanding What a Personal Loan Really Offers

A personal loan is a fixed-term borrowing option that allows individuals to meet planned or unexpected expenses. These loans are typically unsecured, meaning no collateral is required. However, every loan comes with its own conditions, costs, and responsibilities.

While interest rate is a key component, it is only one part of the overall loan structure. Borrowers who focus solely on rates may ignore repayment flexibility, processing charges, or penalties that significantly increase the total cost.

Why Interest Rate Alone Is Not Enough

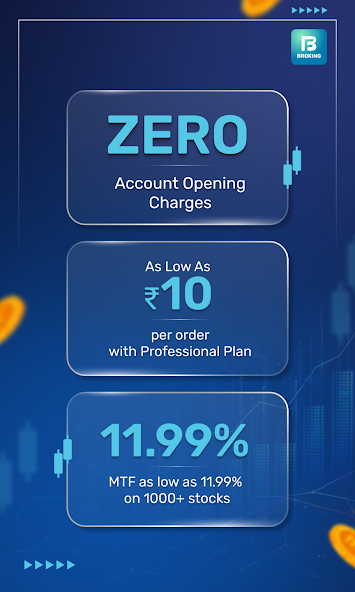

Hidden Charges Increase Loan Cost

Many borrowers discover too late that a loan with a low interest rate includes additional charges. Processing fees, service charges, documentation costs, and administrative expenses can add a substantial amount to the loan value.

A loan with a slightly higher rate but fewer fees may end up being more affordable in the long run.

Repayment Tenure Impacts Affordability

Loan tenure plays a critical role in determining monthly obligations. A shorter tenure may reduce interest outflow but increase monthly stress. On the other hand, longer tenures lower monthly payments but increase the total repayment amount.

The best personal loan balances tenure with repayment capacity rather than focusing on rate alone.

Prepayment and Foreclosure Conditions

Many loans restrict early repayment or impose penalties for closing the loan before its tenure ends. These conditions reduce financial flexibility, especially if your income improves or you wish to reduce debt early.

A loan that allows partial prepayment or early closure without heavy penalties often provides better long-term value.

Speed and Accessibility Matter More Than You Think

Importance of Approval Time

In emergency situations, approval speed matters more than rate. A quick loan app offering fast verification and same-day disbursal may be more helpful than a low-rate loan that takes weeks to process.

Delays can force borrowers to seek alternative financing at higher costs, negating the benefit of a lower interest rate.

Documentation and Eligibility Criteria

Some loans require extensive paperwork, strict credit conditions, or income verification that delays access to funds. Loans with simpler documentation and transparent eligibility norms reduce stress and uncertainty.

Loan Flexibility Is Often Overlooked

Adjustable Repayment Options

Flexibility in repayment schedules helps borrowers manage changing financial situations. Loans that allow changes in repayment dates or installment amounts provide better control over finances.

Rigid repayment structures increase the risk of missed payments and penalties.

Support During Financial Difficulty

Some loan providers offer restructuring options during financial hardship. This feature becomes crucial during unexpected income disruptions.

A loan that supports borrowers during challenging times is more valuable than one offering only a low rate.

Credit Score Impact and Long-Term Effects

Every loan affects your credit profile. Missed payments, rigid terms, or hidden charges can lead to defaults, damaging your credit score.

Loans with clear repayment structures and reminders help borrowers maintain a healthy credit history. Over time, this improves access to better loan terms and financial opportunities.

Evaluating the Total Cost of a Loan

Interest vs Overall Repayment

The true cost of a loan includes interest, fees, penalties, and opportunity costs. Borrowers should evaluate the total repayment amount rather than comparing rates alone.

A transparent loan structure allows you to calculate the real financial impact before committing.

Alignment With Financial Goals

Borrowing should support financial stability, not create pressure. The best personal loan aligns with income flow, future plans, and emergency readiness.

Loans that stretch your monthly budget or restrict flexibility may become liabilities instead of solutions.

Digital Lending and Smarter Borrowing Decisions

Digital platforms have simplified borrowing, but convenience should not replace careful evaluation. Every quick loan app may advertise speed and low rates, but borrowers must review repayment terms, support systems, and transparency.

Technology enables faster access to funds, but responsible borrowing still requires informed decisions.

How to Identify the Best Personal Loan

Key Factors to Compare

Instead of focusing on a single number, borrowers should evaluate:

- Total repayment amount

- Processing and service charges

- Repayment flexibility

- Approval and disbursal time

- Prepayment conditions

- Customer support availability

A loan that performs well across these factors is more reliable than one offering only a low rate.

Reading Terms Before Acceptance

Loan agreements contain critical details that determine borrower experience. Reviewing these terms prevents surprises and protects financial stability.

Understanding your loan fully is the first step toward responsible borrowing.

Conclusion: Choosing Value Over Numbers

The best personal loan is not defined by the lowest interest rate but by how well it fits your financial situation. A loan should offer transparency, flexibility, timely access, and manageable repayment conditions.

In today’s digital environment, every quick loan app promotes speed and affordability, but borrowers must look beyond surface claims. Evaluating the full structure of a loan ensures better control, fewer risks, and long-term financial health.

Before committing to any loan, consider the total cost, repayment experience, and flexibility it provides. A well-chosen loan supports your goals instead of limiting them, proving that value matters more than just a low rate.