Investing in Initial Public Offerings (IPOs) has become increasingly accessible thanks to technology. Today, anyone with a smartphone and a Demat account can participate in IPOs through dedicated investment apps. For both new and seasoned investors, understanding how to use an IPO investment app can significantly enhance your chances of making informed and profitable investments. In this guide, we will explore how to navigate an IPO investment app efficiently, along with stock market tips that can help you optimize your investment strategy.

Understanding IPO Investment Apps

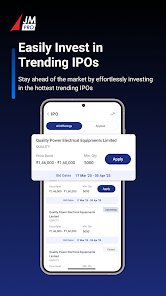

IPO investment apps are designed to simplify the process of applying for IPOs directly from your mobile device. These apps are linked to your Demat account and allow you to view upcoming IPOs, check their price bands, read company prospectuses, and apply for shares in just a few taps.

By providing a seamless and intuitive platform, these apps eliminate the need for manual paperwork and in-person applications, making IPO investing more straightforward. They also often offer real-time notifications, enabling investors to act quickly when high-demand IPOs are announced.

Why Use an IPO Investment App?

Using an IPO investment app offers several advantages:

- Convenience: Apply for IPOs anytime, anywhere.

- Transparency: Access detailed information on IPOs, including subscription status and allotment updates.

- Efficiency: Reduce paperwork and save time by linking directly to your Demat account.

- Analysis Tools: Many apps provide research reports, company financials, and historical stock data to support decision-making.

Investors who leverage these apps can stay updated with market trends and receive tailored stock market tips, which can help them make smarter investment choices.

Step-by-Step Guide to Using an IPO Investment App

1. Set Up Your Account

Before you begin, ensure your Demat account is active and linked to the app. Most apps will require you to enter your account details and complete a quick verification process. Having your account properly connected ensures a smooth application process for IPOs.

2. Explore Upcoming IPOs

Once logged in, browse through the list of upcoming IPOs. Good investment apps provide detailed information, including issue dates, price bands, and the total number of shares being offered. This helps investors compare opportunities and make informed decisions.

3. Read the Prospectus

A prospectus contains critical information about the company, its financials, and the risks involved. Most apps allow you to download or view the prospectus directly, making it easier to analyze before investing. Incorporating stock market tips while reading can help you assess the potential return on investment.

4. Apply for Shares

After evaluating the IPO, you can place your application through the app. Enter the number of shares you want to apply for and ensure the amount is available in your linked bank account. Some apps also allow you to modify or cancel your application before the closing date.

5. Track Allotment Status

Post-application, the app provides real-time updates on the allotment of shares. You can track whether you received the shares, how many, and any refunds for unsuccessful applications. This transparency ensures that you stay informed at every step.

6. Post-Allotment Monitoring

Once the shares are credited to your Demat account, the app often provides market analysis tools to track performance. Monitoring the IPO performance can help you decide whether to hold the shares long-term or sell once the listing occurs.

Tips for Smart IPO Investments

Using an IPO investment app effectively goes beyond merely applying for shares. Here are a few practical stock market tips for maximizing returns:

- Evaluate the company’s financial health and growth potential before investing.

- Diversify your IPO investments instead of putting all funds into a single IPO.

- Keep track of market trends and subscribe to notifications for high-demand IPOs.

- Use the app’s historical data and research features to analyze similar IPO performances.

- Consider your risk tolerance and avoid investing funds that you may need in the short term.

By following these guidelines, investors can enhance their decision-making process and make smart IPO buys.

Common Mistakes to Avoid

Even with a well-designed IPO investment app, mistakes can occur if investors are not careful. Some common pitfalls include:

- Ignoring the prospectus and investing based solely on hype.

- Over-investing in a single IPO without considering diversification.

- Delaying the application and missing high-demand IPOs due to technical delays.

- Failing to link your Demat account properly, leading to application rejections.

Avoiding these errors ensures that your IPO investment journey remains smooth and profitable.

Conclusion

An IPO investment app is an essential tool for modern investors looking to participate in public offerings efficiently. By linking your Demat account and following a structured approach, you can navigate the IPO landscape with confidence. Incorporating stock market tips and monitoring trends through the app allows you to make informed decisions, minimize risks, and potentially maximize returns. Whether you are a novice or an experienced investor, using these apps responsibly can help you build a well-rounded investment portfolio and achieve financial growth.

Remember, the key to successful IPO investing lies in research, planning, and leveraging technology. With an IPO investment app and the right strategies, you can approach each IPO opportunity with clarity and confidence.